Network Statistics and Metircs of Liker Land

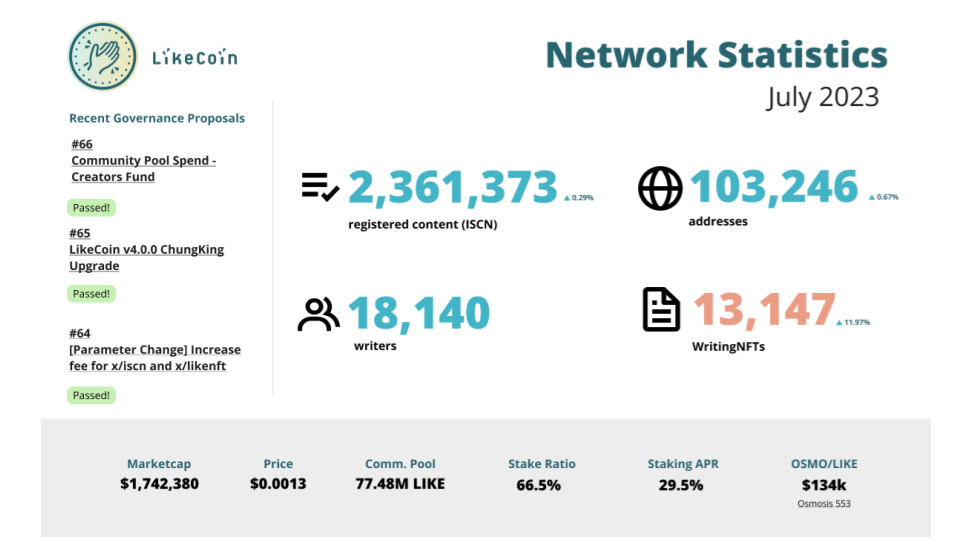

Last month, the Community Call participants raised several related network statistics that we would like to know, and Phoebe also refined some metrics that she believes the community might find more interesting. Focusing on several measurements of the network performance on a monthly basis. The first key metric identified is the ISCN registration number. This metric reflects the core function of the LikeCoin chain, which is the ISCN module. It provides valuable insights into how the chain is performing and the content being generated. The second metric is the number of wallet addresses currently active on the network, that have been experiencing steady monthly growth in terms of new “like” addresses.

Additionally, Phoebe discussed the definition of writers in the context of the network statistics. Currently, writers are defined by those who have registered an ISCN and are associated with a unique address count. If there are other definitions or updates to consider, the community can further discuss them. However, for now, this number is derived from the unique address count of ISCN registrations. Lastly, Phoebe examined the number of Writing NFTs. There is an available public Writing NFT dashboard that provides comprehensive data on the overall number of writing NFTs generated through the LikeCoin chain. This includes various types of NFTs, such as article NFTs or book NFTs, as long as they are generated through the LikeCoin chain under the X NFT module. These metrics offer an overall view of the current performance of the LikeCoin chain.

LikeCoin Gas, Gas Fee, ISCN, wNFT fee

Furthermore, last month kin inquired about the LikeCoin chain’s fee structure and its current usage in terms of tokenomics. Thanks to the Liker Land team, they obtained some numbers from the chain data. The pie chart presented during the meeting represents the major activities on the LikeCoin chain, divided into five pillars. The largest portion of the pie chart represents the creation of ISCN, followed by transactions related to Writing NFT activities. Further breakdown revealed two sections: pre-Writing NFT minting activities and post-minting activities, which may include distributions and other related processes. In total, Writing NFT activities accounted for 31.9% of the LikeCoin chain’s overall activities, making it the third-largest pillar. The transactional type, which includes reward transfers and creator fund distributions, accounted for 20% of the LikeCoin chain’s activities. The remaining three pillars are related to validators and include claiming staking rewards, staking actions, and other transaction percentages related to the overall content activities. Additionally, there is a 6% share dedicated to other types of activities. Overall, the LikeCoin chain consists of three major pillars: Create ISCN, Writing NFT, and transactional types, including reward distribution. This insightful data from the pie chart allows the community to gain a holistic view of the LikeCoin chain’s activities. Once the team cleans up the data, they will be able to share it publicly for those interested in conducting analytics. The team aim to continue monitoring these metrics on a monthly basis and will share updates in the monthly call.

Phoebe has also gathered data from the team to analyze the gas fees and, based on Proposal 64, to examine the fees associated with ISCN and Writing NFTs and their contributions to the community pool. She believes this will be of interest to most of you, especially considering the recent increase in ISCN fees. The gas fees on the LikeCoin chain are currently minimal and have not changed significantly since the chain’s inception. From the birth of the LikeCoin chain until the end of June 2023, there have had over 6 million transactions, with a total gas fee collection of only 47,000 LIKE tokens. At today’s token price, this amounts to approximately 60 to 70 US dollars. Therefore, this could be an area for the community to consider increasing the gas fees.

Out of the total 6 million transactions, over 2 million are ISCN-related transactions, as indicated in the previous pie chart. This means that 32% of the total transactions are ISCN transactions, and the collected gas fees from ISCN alone amount to 8,000 LIKE tokens, which is also quite minimal. This presents an interesting area to examine the gas fee structure.

The second section below presents recent data comparing ISCN and Writing NFT fees before and after the fee increase. It clearly demonstrates a significant difference. The latest monthly data, not including this month or completed weeks, which shows the collective fees generated from creating Writing NFTs and ISCN transactions totaling around 200,000 LIKE tokens. In comparison, prior to Proposal 64, the fees were relatively low, at around 278,000 LIKE tokens, which is roughly one-tenth of the current fees. Moving forward, the community can continue monitoring the fees generated through ISCN and Writing NFTs. As observed, the fees collected from ISCN transactions are much higher than the gas fees. This leads Phoebe to suggest that the community consider which area they would like to modify or optimize in terms of the fees collected for the community pool.

So, these are the performance insights related to the chain. Overall, she find this exercise truly fascinating as helps gain a comprehensive understanding of the holistic performance of the LikeCoin chain. It may also be beneficial for various validators to further investigate how we can improve our performance for the overall community’s benefit.

Creators Fund Reform and how it shapes the future of the community

Secondly, there have been various discussions. The latest proposal revolves around the community pool spend on the creators fund. Edmond provided some further details. Speaking on behalf of the creators committee as one of its members, and he is also the only representative from Liker Land in the community. As Proposal 66 has been passed, and he would like to express my gratitude to everyone who participated in this proposal. The proposal required 1.2 million LIKE tokens, similar to the community pool spend. However, there was an incident where the proposal did not pass before the pool was depleted, resulting in approximately an 11-day period from June 16th to June 25th when the matching funds were not distributed to the creators. He believes this is an opportunity for us to reconsider how we can better utilize the fund.

He has written a short article proposing improvements to the creators fund mechanism. It has been posted on Discord, and you can also provide comments on the Matters articles, specifically in the discussion area. The main proposal is to reform the creators fund committee. Currently, there are a seven-person committee, and he would like to express my appreciation to all of them for their participation in the community for over 18 months. However, he believes it is time to make changes because the situation has been evolving rapidly during this period. There have been significant changes, including personal circumstances, conditions, the environment, and the LikeCoin ecosystem. Therefore, he believes it is necessary to reform the committee and invite new members from the community to join. The details of the proposed changes are outlined in my article, and he invites all of you to take a look if you are interested and participate in the ongoing discussion.

He would also like to provide more information about the key areas that he suggests improving in the creator fund distribution mechanism. He has identified three points in his proposal. Firstly, he believes it is necessary to change the current mechanism that primarily relies on Likes. As Liker Land have shifted the focus from giving Likes to purchasing Writing NFTs for almost a year, we should encourage and support this new direction of the product. This is the first point of improvement. The statistics also show that the fund is currently predominantly benefiting old users rather than new users. He thinks one of the purposes of the fund should be to incentivize and engage newcomers, especially those who are new to the LikeCoin ecosystem or do not possess LikeCoin, and encourage them to actively utilize LikeCoin’s facilities. This is another important direction to consider. Lastly, we should reform the CFC (Creators Fund Committee) to make decision-making more efficient. He welcomes all of you to join the discussion on Discord. If you are interested in becoming a Committee Member in the new CFC, please feel free to express your willingness.

Streamlined experience of LikeCoin chain with Keplr and Stripe

Following other news in the ecosystem, Liker Land team have been focusing on improving the user onboarding experience. Currently, there are several wallets that drive users to onboard on Liker Land, and Keplr has been one of them. However, onboarding on Keplr used to be quite manual. Previously, when a new user onboarded on LikeCoin, they had to manually add LIKE to their Keplr Plugin or roll it. However, last month, Liker Land finally achieved native integration with the Keplr wallet. This is a significant milestone, as Liker Land team are now able to work closely with a major ecosystem partner. Onboarding to LikeCoin has become much easier for new users, enhancing their experience and providing a one-stop shop for new and existing likers to participate in governance, manage their assets, and use the mobile wallet to interact with applications efficiently, whether on web or mobile. Liker Land team have eagerly anticipated this development and encourage you to test out the flow. If you encounter any difficulties, please let them know. They are also working towards adding Liker Land as a DApp in the Keplr mobile app section, further improving the user experience after integration. This integration is also an excellent opportunity for others in the Cosmos community to learn about our activities, making it a valuable share.

Additionally, Liker Land has updated Wallet Connect to version 2.0. As a user, you may not notice any changes, which indicates a successful integration. Liker Land team invested considerable time in ensuring a smooth migration from Wallet Connect 1.0, which has now been sunsetted. If you encounter no issues when using Wallet Connect to engage with LIKE online, it means they have successfully migrated you to Wallet Connect 2.0, providing an enhanced user experience through the wallet connect provider. Liker Land team are pleased to have connected users to various wallet service providers. Please inform them if you experience any difficulties.

As a Liker Land user, you might have already noticed an improvement in the onboarding experience. Last month, the Liker Land team collaborated with Stripe to enable Layman users to directly purchase Writing NFTs using Stripe. Liker Land team worked closely with Stripe, undergoing all the necessary due diligence, and have officially gained their support. This is another significant milestone for Liker Land, as it means that Liker Land payments can now be made through the Stripe portal. This seamless integration allows users, even those without cryptocurrency or LIKE tokens, to purchase items using fiat currency and their credit cards. If you have friends who wish to purchase your Writing NFTs but don’t possess LIKE tokens, they now have a solution. They no longer have any excuses not to support you, as long as they have a credit card. This achievement showcases successful partnership with a well-known brand, allowing Liker Land team to process payments for users. Liker Land team hope to leverage additional functions provided by Stripe in the future, and are actively working towards that goal. This is an exciting development to share within the Liker Land and LikeCoin ecosystem.

Parameters discussions on Minimum Commission and Inflation Rate

kin would like to bring attention to the validators regarding gas fee expenditures in building NFTs and other related issues. Apart from this specific parameter, he mentioned that there are other parameters to consider. One of them is the minimum commission, which some validators have expressed interest in setting at a certain percentage, such as five percent or higher. It was not supported in the previous version of the LikeCoin chain, but as far as he understand, it is now supported. However, he has not conducted tests on the production environment yet, so validators may want to follow up on that. He personally don’t have a strong opinion on this matter since he is not a validator, so he’ll leave it to the mainnet validators.

Another topic he wants to touch upon is the inflation of the LikeCoin chain. He doesn’t have detailed information about it at the moment, but based on his understanding of the design, considering the staking ratio is close to 66.7 percent, the inflation shouldn’t be too high right now. It should be within the cap of 20 percent, given that we have a staking ratio of 66 percent (although it’s not exactly that at the moment, it’s very close). Therefore, he believes we don’t need such a high inflation rate at the moment. However, he is not sure about the current situation. He has initiated a discussion in the main network channel of Discord, and validators and others may want to take a look and decide what actions we should take publicly to address this, whether it’s an error or a misunderstanding.

Currently, the second ratio displayed in Big Dipper and Mintscan shows different numbers. It would be helpful if Liker Land team could manually calculate and update the numbers for the community.